山東三元生物科技股份有限公司

more

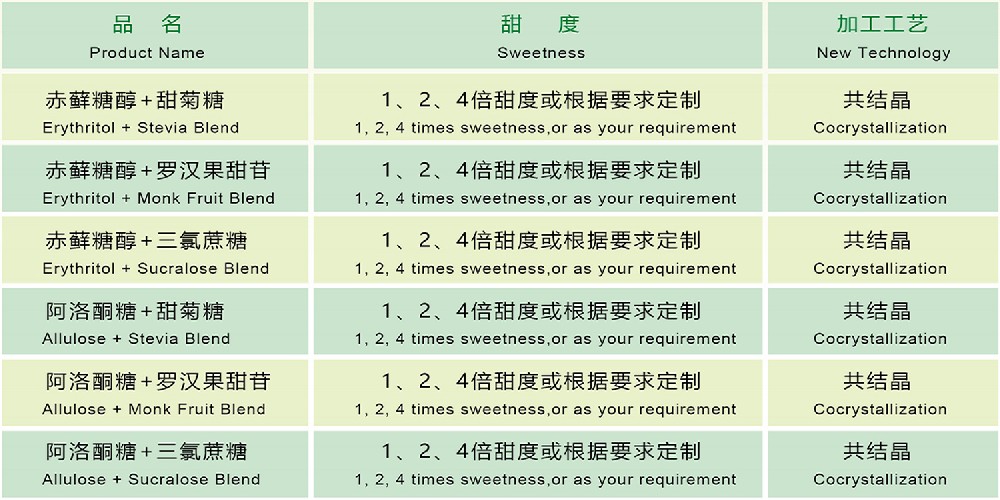

山東三元生物科技股份有限公司成立于2007年,是一家集研發(fā)、生產(chǎn)、銷售為一體的高新技術(shù)生物科技企業(yè),致力于發(fā)酵法生產(chǎn)赤蘚糖醇及新型多功能糖的研究和開發(fā)。公司位于山東省濱州工業(yè)園區(qū),占地面積330畝,擁有年產(chǎn)13.5萬噸赤蘚糖醇和2萬噸阿洛酮糖的生產(chǎn)能力。公司目前與國內(nèi)知名高校合作建立了健康糖工程技術(shù)研發(fā)中心,并在天津自貿(mào)區(qū)空港經(jīng)濟區(qū)注冊成立了“三元生物工程研究(天津)有限公司”,致力于構(gòu)建集研發(fā)、實驗、中試和產(chǎn)業(yè)化于一體的產(chǎn)品創(chuàng)新體系。公司擁有15項國家知識產(chǎn)權(quán)專利和3項實用新型專利,產(chǎn)品質(zhì)量達到國際領(lǐng)先水平,已通過ISO9001(質(zhì)量管理)、ISO14001(環(huán)境管理)、ISO22000(食品安全管理)三體系認證、食品安全全球標準認證(BRC)、猶太潔食認證(KOSHER)、清真潔食認證(HALAL)、IP非轉(zhuǎn)基因供應(yīng)鏈標準認證、社會責(zé)任審核(SMETA)等相關(guān)國內(nèi)外權(quán)威資質(zhì)認證。公司擁有自營進出口權(quán),外銷市場以歐美地區(qū)為主,遍布東亞、東南亞、澳新等40多個國家和地區(qū)。產(chǎn)品被科技、環(huán)保、商務(wù)、檢驗檢疫-“四部委”認定為國家重點新產(chǎn)品,廣泛應(yīng)用于食品、飲料、保健品、醫(yī)藥、化妝品等各行業(yè)領(lǐng)域中。隨著健康、養(yǎng)生、綠色生活理念的提···